Apple lowers revenue forecast

Last evening after market close, Apple lowered their revenue forecast, for Q1 2019. On an interview with Josh Lipton from CNBC, Apple CEO Tim Cook, explained/blamed the the US China trade war for lower iPhone sales. The news came as a shock to the market, an immediately the stock plunged from $158 to $145.

Right now it is trading around $143 which is 9% drop from yesterday.

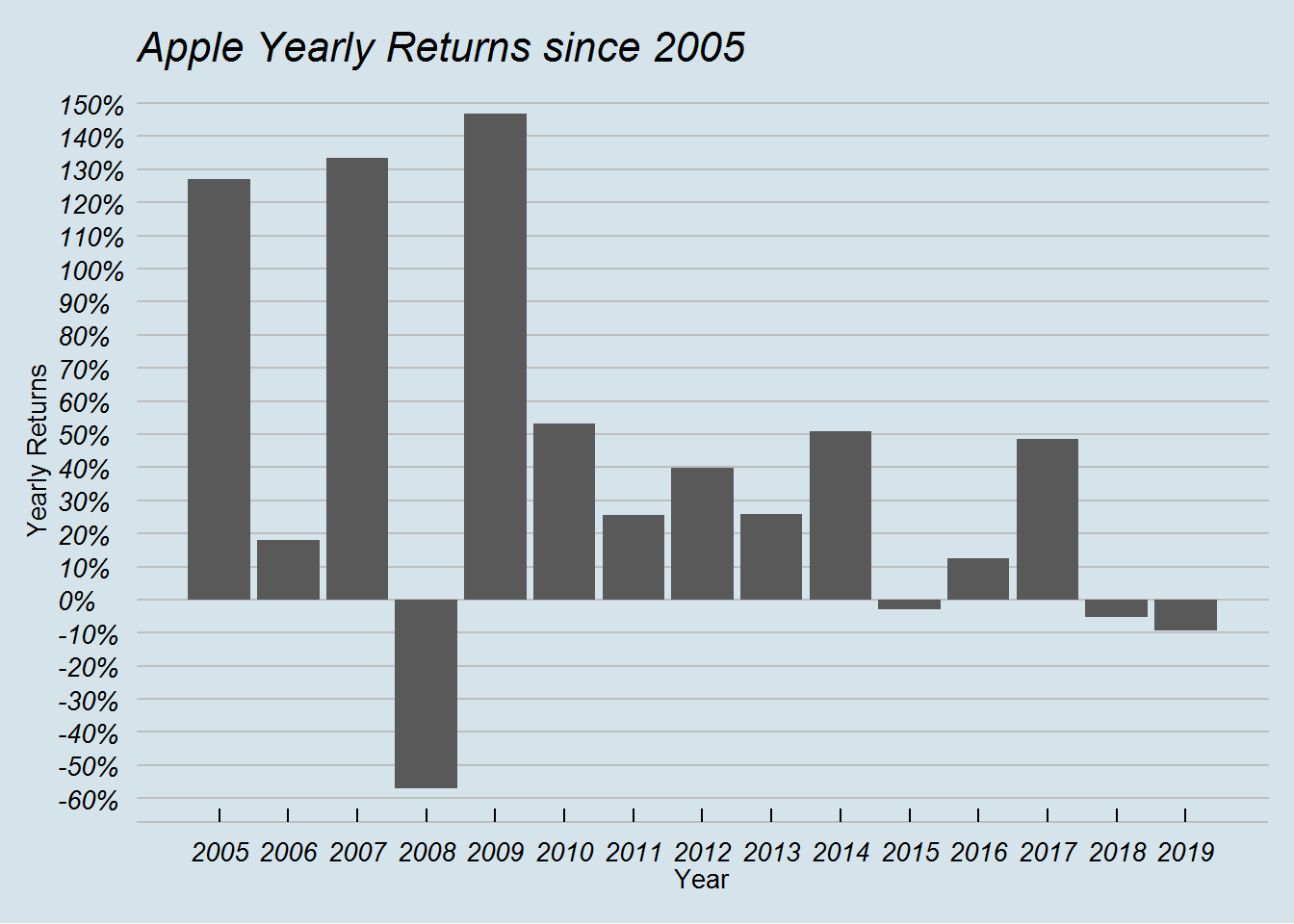

Performance since 2005

Recent performance has been lackluster compared to the past

Apple has had phenomenal returns since 2008 financial crisis. 2015 and 2018 saw low single digits negative returns. But the low single digit returns in 2018 may not tell the whole story. Lets look at the three months rolling returns for Apple since 2005.

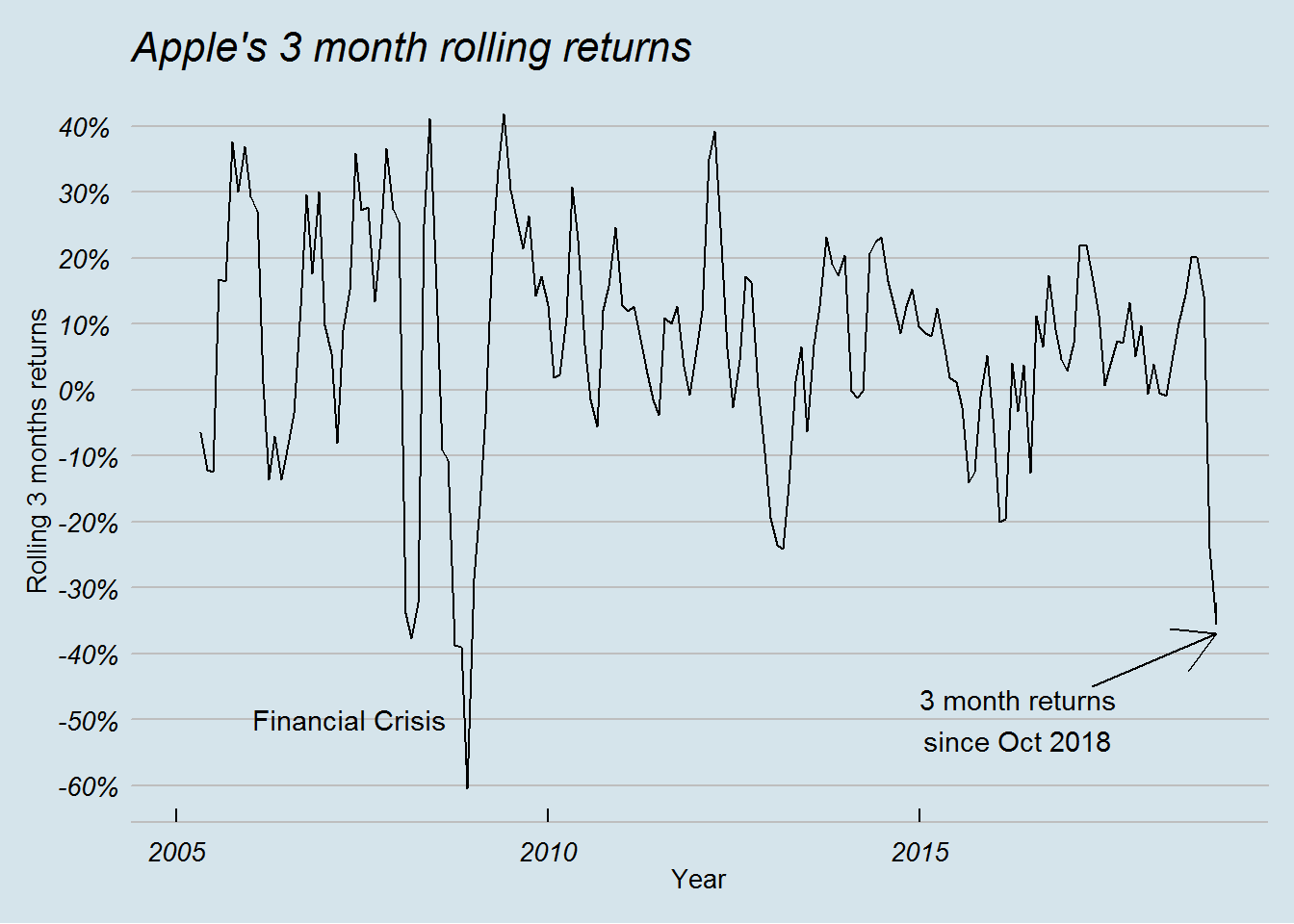

Worst three month performance for Apple since financial crisis

The last 3 months were bad for Apple. The stock is now down almost 40% since October. This is also one of the main reasons for the stock market’s drops since October 2018. So the trade wars are hurting companies like Apple and in turn the major US markets.

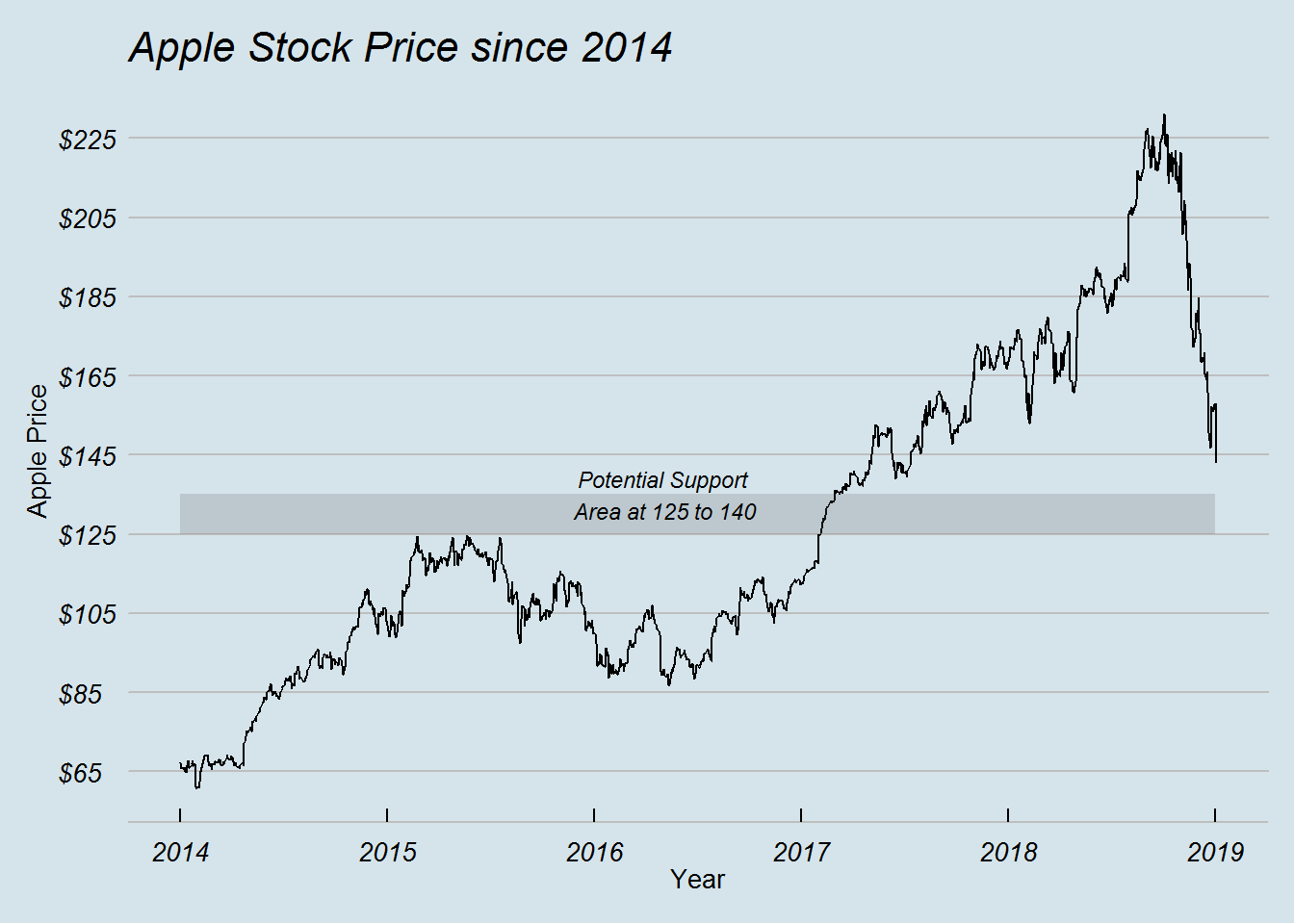

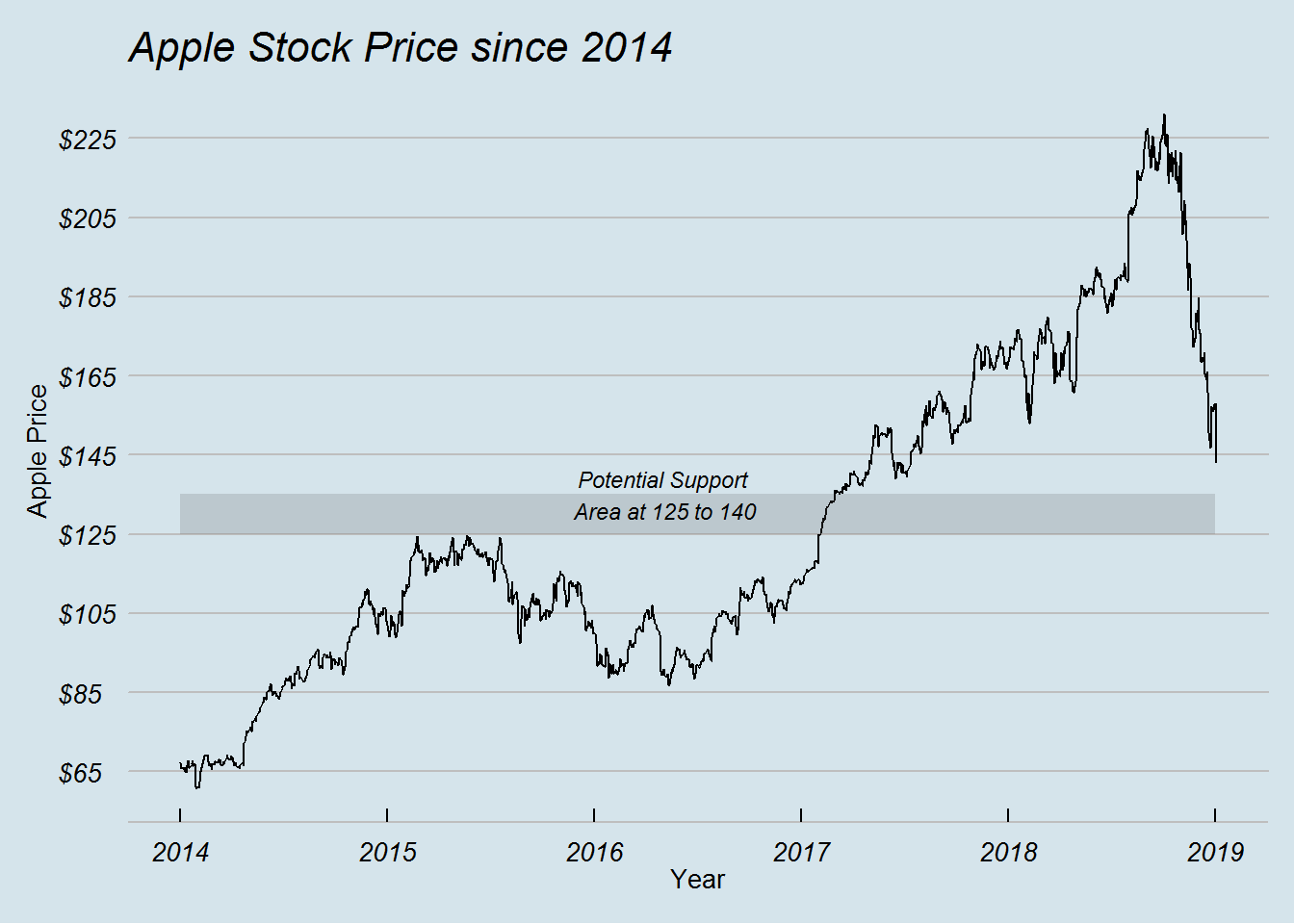

Possible Support at $140 to $120 range

Apple’s Biggest Bull

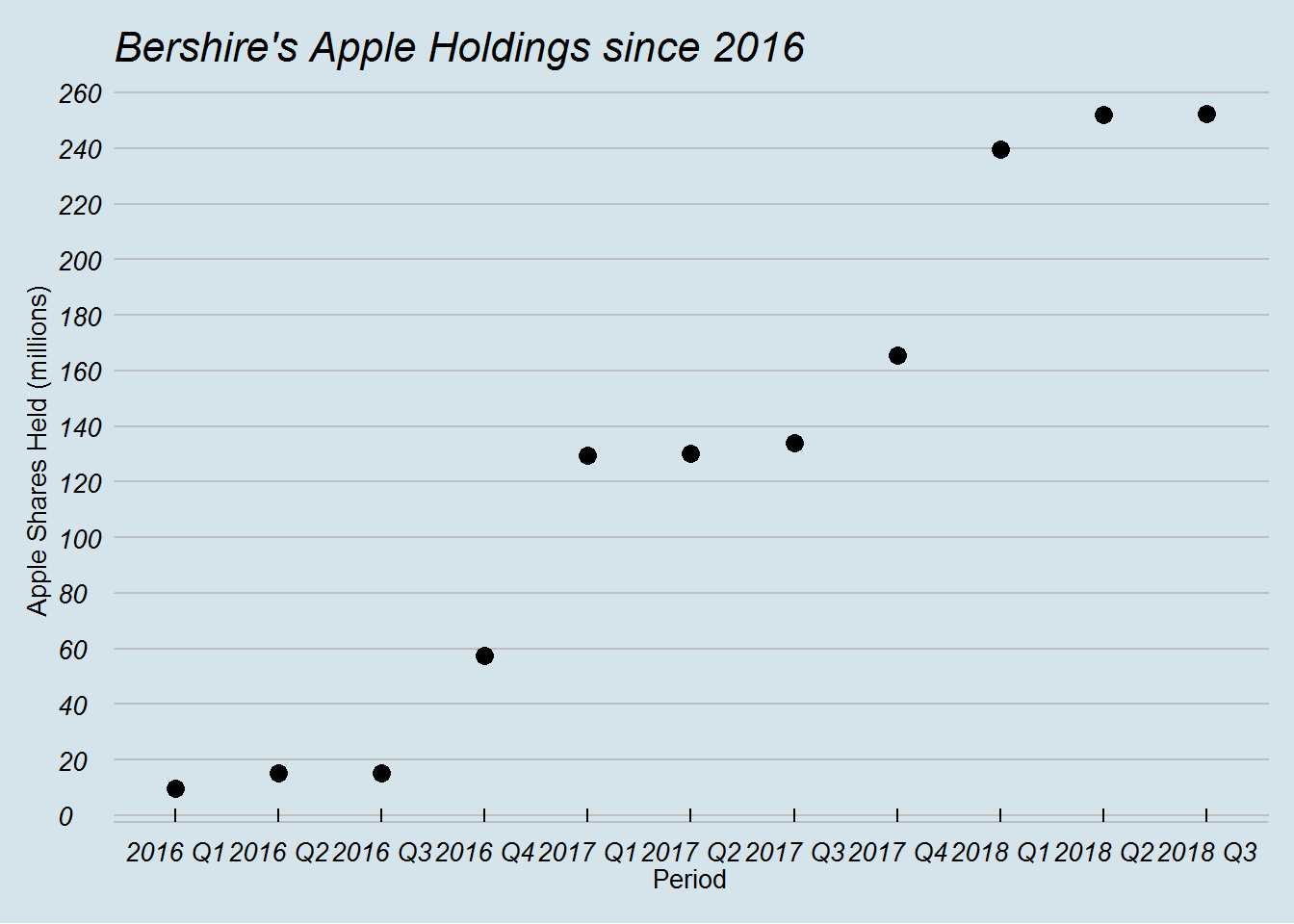

For years Warren Buffett has avoided tech sector and technology companies. All that changed when he started buyng Apple shares since 2016. As of last reporting, Warren Buffett owns more than 250 million shares of Apple. Since October 2018, his portfolio has lost more than $22 Billions on Apple stock.

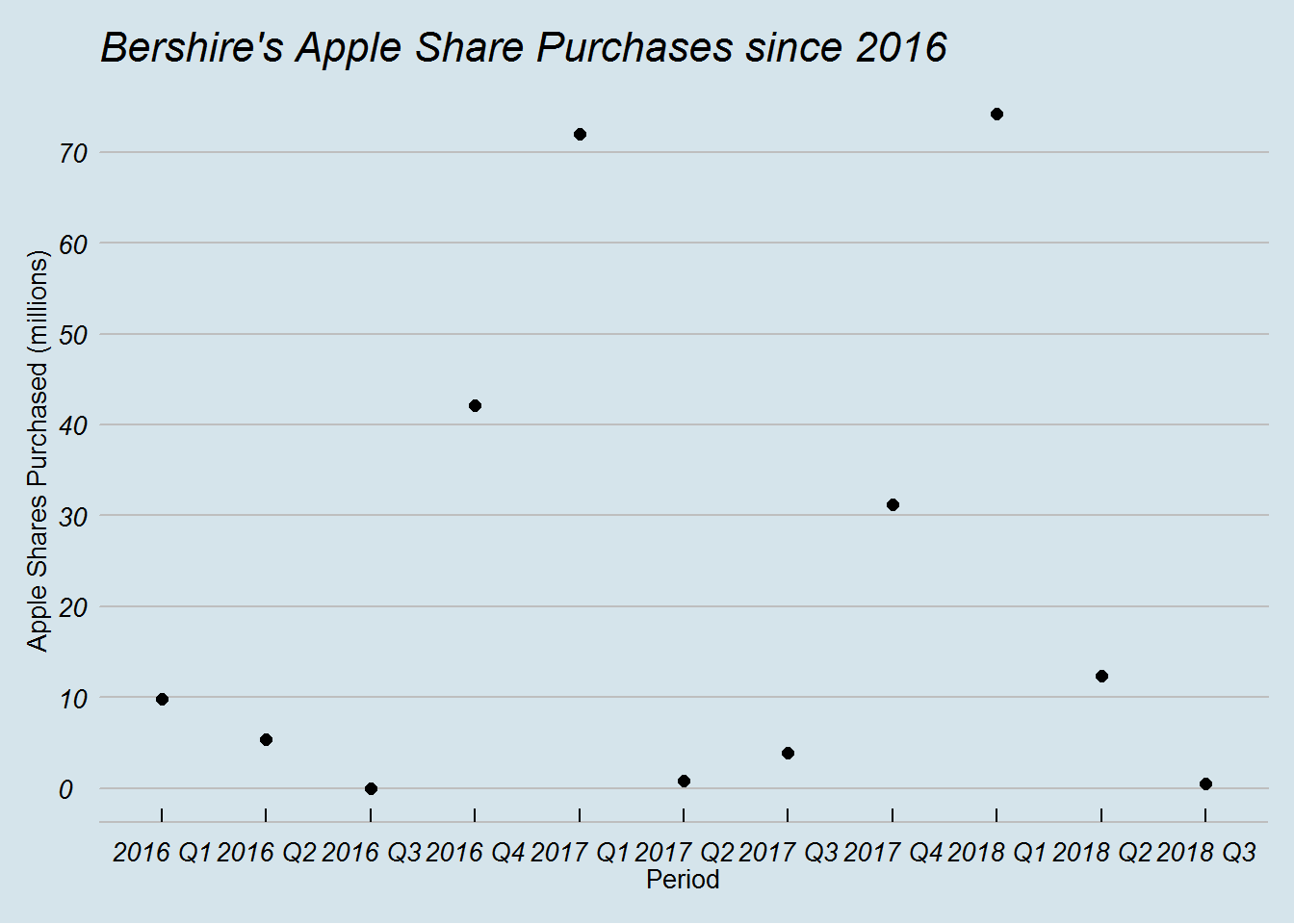

We can see that Warren Buffett is making a huge bet on Apple and owns more than 250 million shares. Its also interesting to see that majority of his purchases have been made in the Q1 of each of the past 2 years.

Will Buffett and other Apple bull step in to make more purchases, given the 40% drop in price since October 2018.

Apple stock has generated great returns for the past decade, but its under increasing pressure. Its flagship product the iPhone does not generate the same level of excitement as it once did in the past. The stock has sold off a lot in the last three months and may find support in the $125 to $140 area. Apple is still a huge component of all three major index, Dow, S&P and Nasdaq. If Apple continues to sell off further, then this will be bad news for the overall markets.