World Markets

Market Review 2018

We began this year on a high note. Markets around the world rallied 7 to 8% in January. But February saw a quick 10% correction. Since then the stock markets have mostly gone sideways. But the volatility has increased a lot in the last few weeks.

Below are some reasons for the sideways market

Trade wars

Since Donald Trump took control of the White House he had been eager to reduce the US trade deficits. He wanted to put tariffs on other countries. This policy was not supported by most economist, but Trump with a tweet commenced the trade wars. In March, Trump tweeted “Trade wars are good and easy to win”. Well he got his trade war, but so far there is no win. In our view tariffs are an indirect tax on the consumer. If Trump puts a 15% tariff on BMW, then BMW increases the price on its cars by 15% and passes the cost to the customer. This also hurts exporting economies such as South Korea and Germany since their goods are now more expensive. In the end trade wars hurt the US consumers and foreign exporters. Its a lose-lose situation. Recently Trump met Xi at the G20 meeting. Trade was the major discussion, and China agreed to lower tariffs on cars and said that they will allow foreign companies more access in its vision 2025 plan. Trump on the other hand gave China 90 day deadline to sort things out. Leading the trade talks for the US side is Robert Lighthizer, he has been a big China bear and more skeptical of China and its intentions. On top of that, Canada recently arrested the CFO Huawei in Vancouver, on behalf of America. US has accused the CFO of bank fraud and selling technology parts to Iran. This was an important development and sent shock waves around the world. Huawei is the most important company in China and the CFO is the daughter of Huawei’s founder and has close ties to the Chinese government. Many US executives are now fearful of traveling to China to do business, as they could also get arrested in retaliation. This could have major disruptions in the Global trade.

Fed interest rates hike

Since 2015 the FED has started hiking interest rates. During the financial crisis, the FED Funds rate were 0% and today they are at 2.25%. The FED is expected to do one more rate hike this year (we will find out on December 19th). They were indicating 4 hikes in 2019. On October 4th, FED chair Jerome Powell gave a speech where he said that the neutral rate (FEDs target interest rates) were “a long way away”. This caused a drop of 6% in October. Since then Powell seemed to have walked back on this statement, and indicated that rates are “just below neutral rates” and this made the markets rally, but this rally fizzled away on the new of the CFO arrest. So we have a perfect storm of geopolitical issues and FED’s tightening policy. But there are now indications that the FED might now hike the rates next year, given the weakness in the recent days. Is it too late, and are we going into recession in 2019/2020. These will be important issue going into next year.

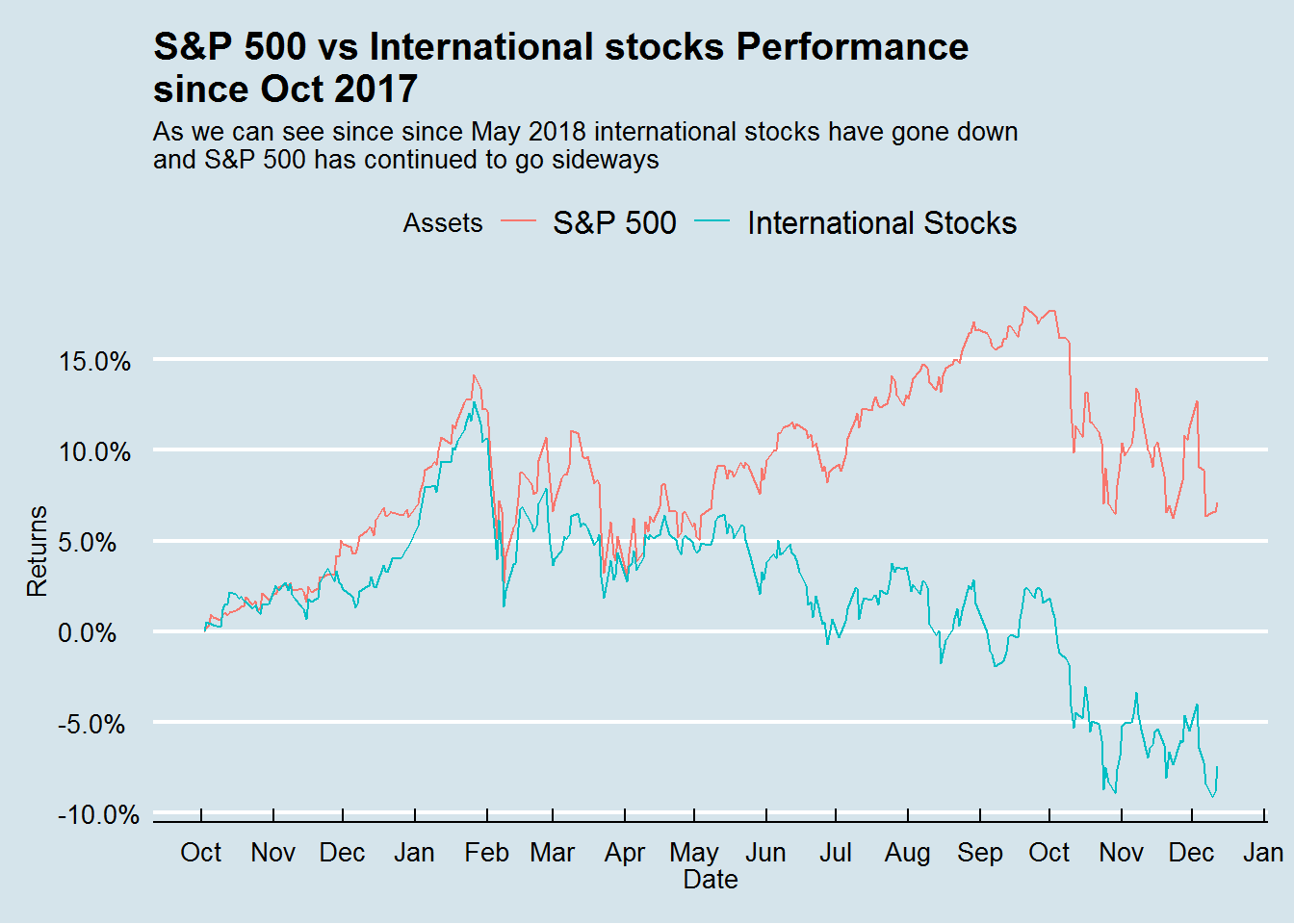

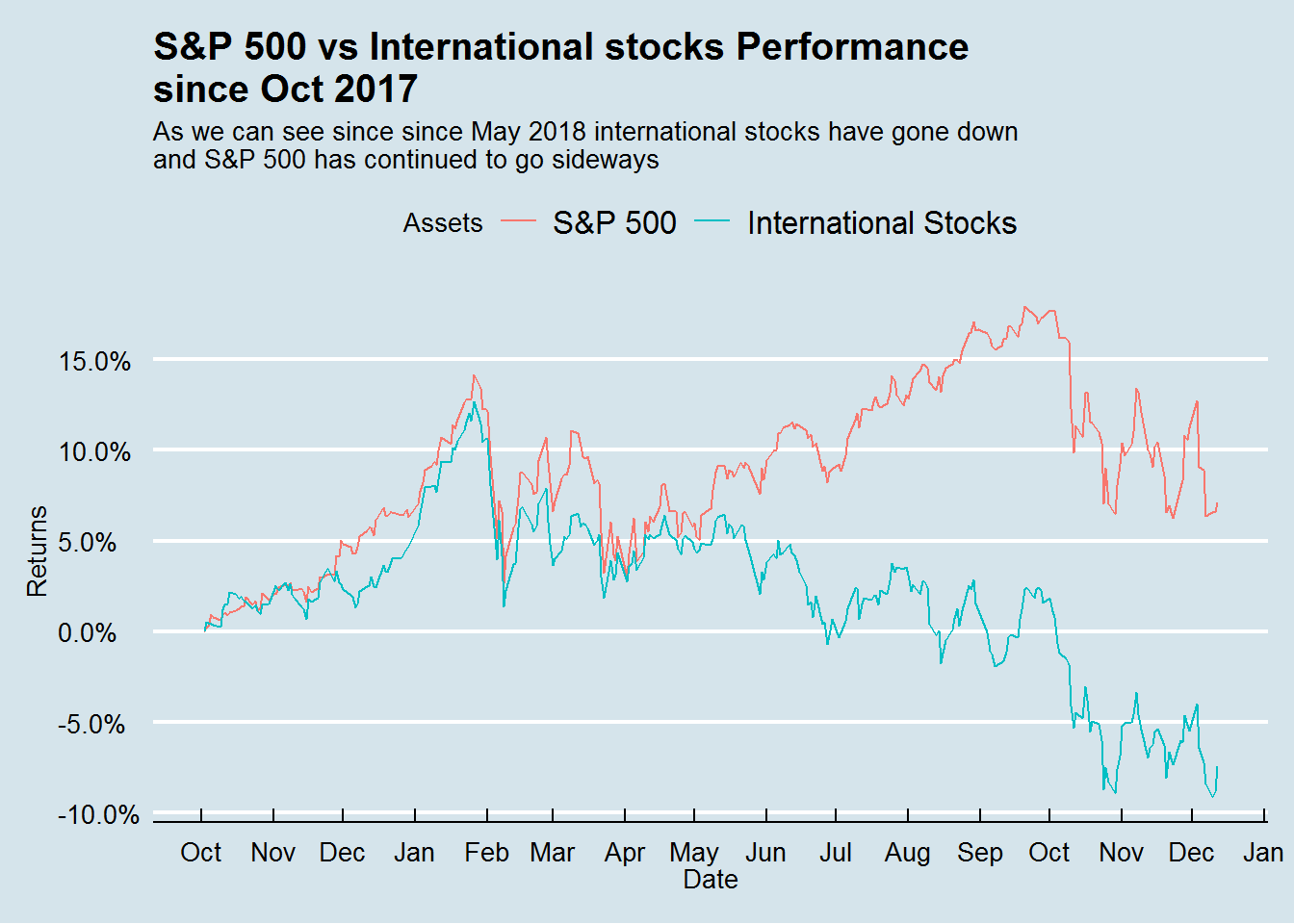

One of the major indication of this sell off was the early summer divergence between the US stocks and the FTSE All world stocks Ex US stocks index. Below we can see how their relationship broke in May.

After the summer of 2018 S&P 500 continued to rally but the rest of the kept drifting lower. Next we will look at the overall performance of major markets around the world.

Major Asset Returns for 2018

| Name | Percent Returns |

|---|---|

| Healthcare | 12.48 |

| Utilities | 9.91 |

| Consumer discretionary | 6.88 |

| Tech | 4.37 |

| Dow Jones REIT | 1.86 |

| U.S. Real Estate | 1.54 |

| 1-3 year TBonds | 0.79 |

| S&P 500 | 0.78 |

| Municipal Bonds | 0.12 |

| Junk Bonds | -0.85 |

| 3-7 year TBonds | -1.02 |

| Consumer staples | -1.15 |

| Brazil | -2.77 |

| U.S. Telecom | -2.80 |

| Investment Grade Corporate Bonds | -4.32 |

| 20+ year Bonds | -4.40 |

| Gold Etf | -4.74 |

| Switzerland | -5.69 |

| Commodities | -6.74 |

| Hong Kong | -7.35 |

| Malaysia | -8.25 |

| Industrial | -8.73 |

| Taiwan | -8.84 |

| Pacific Ex Japan | -9.14 |

| Japan | -9.65 |

| France | -10.03 |

| India | -10.19 |

| Australia | -10.25 |

| Singapore | -10.33 |

| Energy | -10.51 |

| Financial | -10.54 |

| EAFE | -11.00 |

| Sweden | -11.02 |

| Netherlands | -11.23 |

| Materials | -12.40 |

| Canada | -12.55 |

| UK | -12.70 |

| Spain | -13.28 |

| MSCI EMU | -14.04 |

| Italy | -14.45 |

| North American Natural Resources | -14.71 |

| Mexico | -16.41 |

| Belgium | -16.75 |

| Austria | -18.58 |

| Germany | -19.35 |

| South Korea | -19.97 |

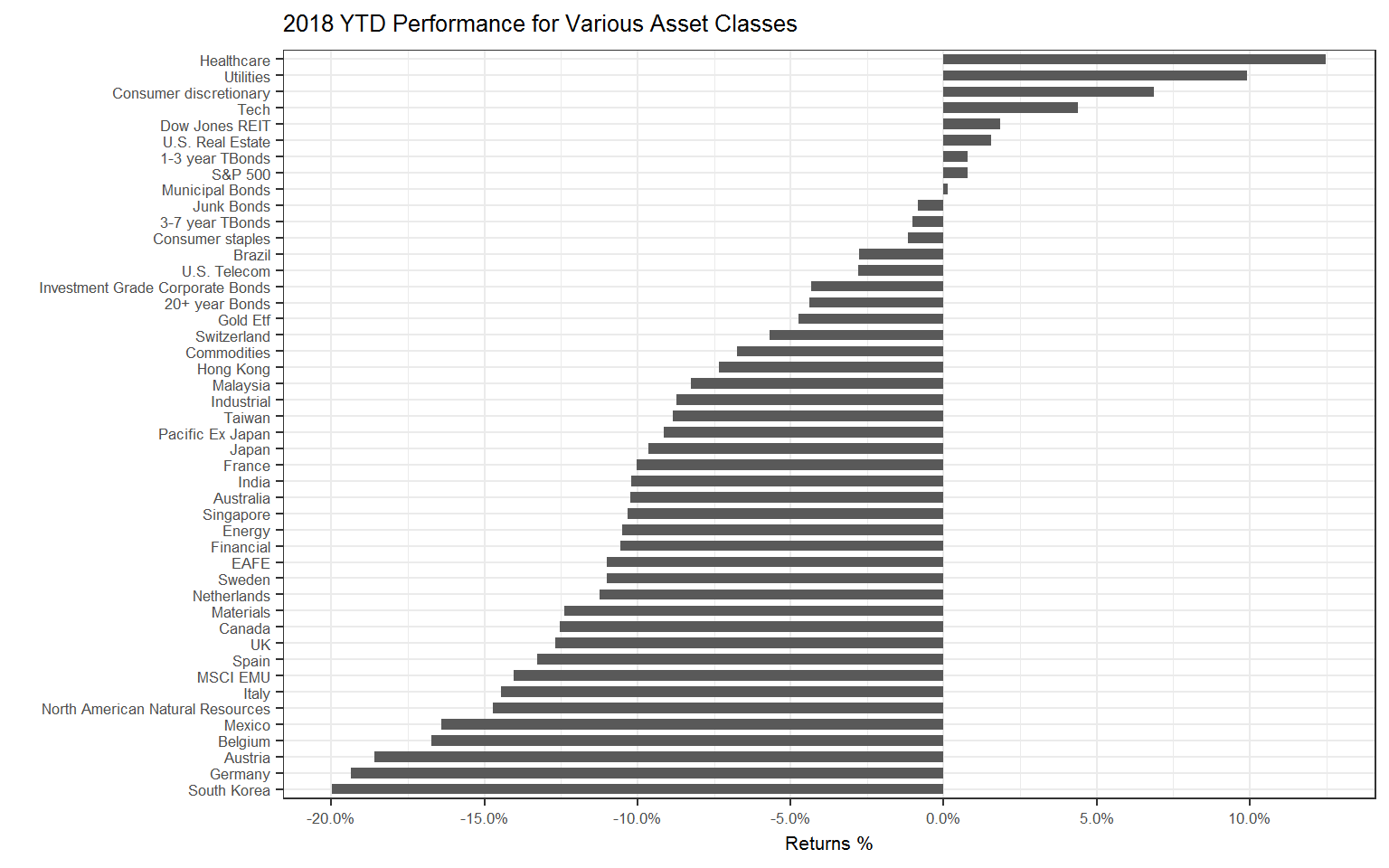

Asset Class Performance Chart

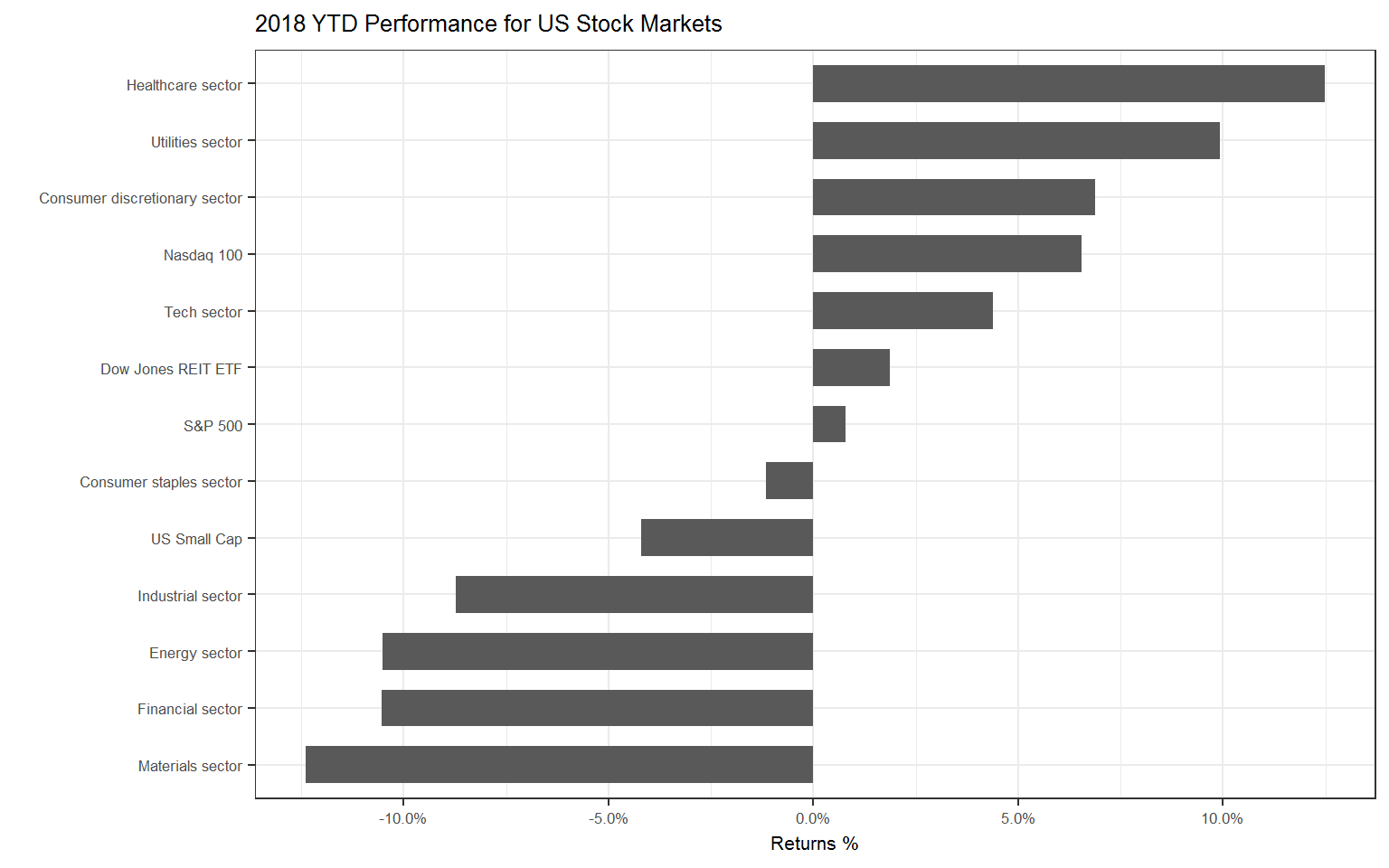

Its clear from the table and chart above, that 2018 was not a good year for investors. We saw negative returns across several asset classes. South Korea and Germany had the worst performance of all. We can see that most Asian and European stocks were hurt this year. S&P 500 on the other hand is flat. We can also see that bonds were also down or flat.

Looking at the above chart we can see that recession proof sectors such as health care and utilities were the best performers and cyclical sectors such as energy, material, industrials suffered as a result of the trade war. NASDAQ and tech sector managed to stay positive but, they were up almost 20% at the end of September. Next we will look at individual names.

| Symbol | Name | Sector | Returns |

|---|---|---|---|

| BSX | BOSTON SCIENTIFIC CORPORATION | Health Care | 46.76 |

| MRK | MERCK & CO. , INC. | Health Care | 42.02 |

| AMZN | AMAZON.COM, INC. | Consumer Discretionary | 39.91 |

| FOX | N/A | Communication Services | 39.58 |

| LLY | ELI LILLY AND COMPANY | Health Care | 38.42 |

| FOXA | TWENTY-FIRST CENTURY FOX INC | Communication Services | 38.21 |

| ADBE | ADOBE INC | Information Technology | 38.18 |

| ISRG | INTUITIVE SURGICAL, INC. | Health Care | 37.41 |

| NFLX | NETFLIX INC | Communication Services | 36.71 |

| CRM | SALESFORCE.COM, INC. | Information Technology | 34.17 |

| INTU | INTUIT INC. | Information Technology | 32.95 |

| MA | MASTERCARD, INC. | Information Technology | 32.56 |

| CME | CME GROUP INCORPORATION | Financials | 32.33 |

| MSFT | MICROSOFT CORPORATION | Information Technology | 29.11 |

| ESRX | EXPRESS SCRIPTS HOLDING COMPANY | Health Care | 28.84 |

| CSCO | CISCO SYSTEMS INCORPORATED | Information Technology | 25.74 |

| ABT | ABBOTT LABORATORIES | Health Care | 25.63 |

| PFE | PFIZER INC. | Health Care | 25.51 |

| TMO | THERMO FISHER SCIENTIFIC INC. | Health Care | 25.31 |

| ANTM | ANTHEM INC | Health Care | 24.73 |

| UNH | UNITEDHEALTH GROUP INCORPORATED | Health Care | 24.02 |

| CSX | CSX CORPORATION | Industrials | 23.91 |

| TJX | TJX COMPANIES INC | Consumer Discretionary | 23.74 |

| COST | COSTCO WHOLESALE CORPORATION | Consumer Staples | 22.23 |

| ADP | AUTOMATIC DATA PROCESSING, INC. | Information Technology | 22.18 |

| V | VISA INCORPORATION | Information Technology | 21.14 |

| COP | CONOCOPHILLIPS | Energy | 20.10 |

| NEE | NEXTERA ENERGY INC | Utilities | 20.07 |

| AET | AETNA INC. | Health Care | 18.99 |

| AMT | AMERICAN TOWER CORPORATION | Real Estate | 18.59 |

| NKE | NIKE INC. | Consumer Discretionary | 18.38 |

| MDT | MEDTRONIC PLC | Health Care | 18.38 |

| SBUX | STARBUCKS CORPORATION | Consumer Discretionary | 17.41 |

| PYPL | PAYPAL HOLDINGS INC | Information Technology | 17.15 |

| AMGN | AMGEN INC. | Health Care | 14.23 |

| DUK | DUKE ENERGY CORP | Utilities | 12.70 |

| WBA | WALGREENS BOOTS ALLIANCE INC | Consumer Staples | 12.63 |

| BA | BOEING CO | Industrials | 12.22 |

| VZ | VERIZON COMMUNICATIONS | Communication Services | 12.03 |

| KO | THE COCA-COLA CO | Consumer Staples | 11.82 |

| SPG | SIMON PROPERTY GROUP, INC. | Real Estate | 10.97 |

| DHR | DANAHER CORPORATION | Health Care | 10.90 |

| UNP | UNION PACIFIC CORPORATION | Industrials | 10.81 |

| SYK | STRYKER CORPORATION | Health Care | 10.24 |

| AXP | AMERICAN EXPRESS COMPANY | Financials | 10.21 |

| EL | ESTEE LAUDER COMPANIES INC | Consumer Staples | 9.93 |

| BDX | BECTON DICKINSON AND CO | Health Care | 9.53 |

| MCD | MCDONALD’S CORP | Consumer Discretionary | 8.61 |

| JNJ | JOHNSON & JOHNSON | Health Care | 8.52 |

| PG | PROCTER & GAMBLE CO | Consumer Staples | 7.38 |

| MDLZ | MONDELEZ INTERNATIONAL INCORPORATED | Consumer Staples | 5.68 |

| ACN | ACCENTURE PLC | Information Technology | 4.97 |

| INTC | INTEL CORPORATION | Information Technology | 4.66 |

| CVS | CVS HEALTH CORP | Health Care | 4.24 |

| BKNG | BOOKING HOLDINGS INC | Consumer Discretionary | 4.00 |

| ORCL | ORACLE CORPORATION | Information Technology | 3.11 |

| CI | CIGNA CORPORATION | Health Care | 2.56 |

| LOW | LOWE’S COMPANIES, INC. | Consumer Discretionary | 2.40 |

| PEP | PEPSICO INC. | Consumer Staples | 2.39 |

| DIS | WALT DISNEY CO | Communication Services | 1.96 |

| GOOGL | ALPHABET INC | Communication Services | 0.05 |

| GOOG | ALPHABET INC | Communication Services | -0.12 |

| AAPL | APPLE INC. | Information Technology | -0.36 |

| AVGO | BROADCOM INC | Information Technology | -2.44 |

| WMT | WALMART INC | Consumer Staples | -3.32 |

| BIIB | BIOGEN INC | Health Care | -3.46 |

| HON | HONEYWELL INTERNATIONAL INCORPORATED | Industrials | -4.14 |

| JPM | JPMORGAN CHASE & CO. | Financials | -4.28 |

| EOG | EOG RESOURCES INC | Energy | -4.30 |

| UTX | UNITED TECHNOLOGIES CORPORATION | Industrials | -4.54 |

| HD | HOME DEPOT INC | Consumer Discretionary | -5.26 |

| USB | U.S. BANCORP | Financials | -5.44 |

| LMT | LOCKHEED MARTIN CORPORATION | Industrials | -5.81 |

| CVX | CHEVRON CORPORATION | Energy | -5.88 |

| GILD | GILEAD SCIENCES, INC. | Health Care | -5.92 |

| ABBV | ABBVIE INC | Health Care | -6.46 |

| TXN | TEXAS INSTRUMENTS INCORPORATED | Information Technology | -6.89 |

| XOM | EXXON MOBIL CORPORATION | Energy | -6.89 |

| QCOM | QUALCOMM INCORPORATED | Information Technology | -6.97 |

| CB | CHUBB LTD | Financials | -8.12 |

| CMCSA | COMCAST CORPORATION | Communication Services | -8.43 |

| AGN | ALLERGAN PLC | Health Care | -9.05 |

| CHTR | CHARTER COMMUNICATIONS INC | Communication Services | -9.22 |

| BMY | BRISTOL-MYERS SQUIBB COMPANY | Health Care | -10.49 |

| CL | COLGATE-PALMOLIVE CO. | Consumer Staples | -11.01 |

| MMM | 3M COMPANY | Industrials | -12.96 |

| PNC | PNC FINANCIAL SERVICES GROUP INCORPORATED | Financials | -13.04 |

| UPS | UNITED PARCEL SERVICE, INC. | Industrials | -15.49 |

| BAC | BANK OF AMERICA CORPORATION | Financials | -16.49 |

| PM | PHILIP MORRIS INTERNATIONAL INCORPORATION | Consumer Staples | -16.53 |

| T | AT&T INC. | Communication Services | -17.11 |

| SCHW | CHARLES SCHWAB CORP | Financials | -17.65 |

| IBM | INTERNATIONAL BUSINESS MACHINES CORPORATION | Information Technology | -17.90 |

| CAT | CATERPILLAR INC. | Industrials | -18.38 |

| WFC | WELLS FARGO & COMPANY | Financials | -19.57 |

| MS | MORGAN STANLEY | Financials | -20.07 |

| FB | FACEBOOK INCORPORATION | Communication Services | -20.35 |

| BLK | BLACKROCK, INCORPORATION | Financials | -21.42 |

| MO | ALTRIA GROUP, INC. | Consumer Staples | -21.88 |

| DWDP | DOWDUPONT INC | Materials | -22.64 |

| C | CITIGROUP INC. | Financials | -23.05 |

| NVDA | NVIDIA CORPORATION | Information Technology | -25.10 |

| GS | GOLDMAN SACHS GROUP INC | Financials | -29.94 |

| KHC | KRAFT HEINZ CO | Consumer Staples | -34.62 |

| SLB | SCHLUMBERGER LIMITED | Energy | -38.38 |

| GE | GENERAL ELECTRIC COMPANY | Industrials | -61.68 |